I’ve got a safe deposit box. I do not know you, but I am wondering that YOU have a safe deposit box also! At the very least, if you’ve got any minds in your mind you do! In this very day and age, with personality theft this kind of development business, it’s more crucial than ever to help keep all your crucial papers in a safe deposit box.

And needless to say, it’s always a good idea to help keep other valuables besides crucial documents, I’m speaing frankly about jewelry, unusual coins, gold bars, diamonds, an such like in a security deposit box. Or can it be?

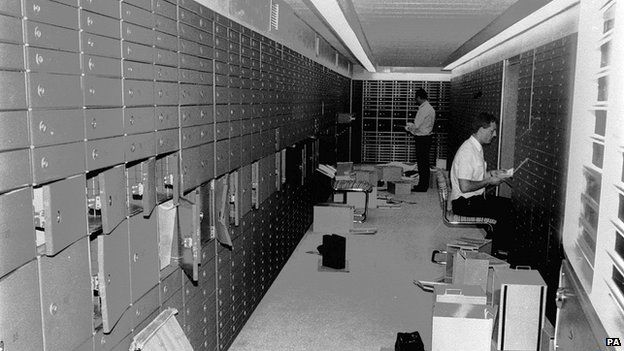

Exactly how safe IS your safe deposit box ? Certain, it’s in a bank….but banks get robbed all the time. Sometimes robbers move directly to the deposit boxes because they know that is where the great stuff is. After all, it’s difficult to walk out of a bank with big bags of cash (those points are incredibly large!), but when they can walk out with a handful of diamonds that may be worth millions of dollars…well, you receive the idea.

And that you do not just have to bother about theft…there’s always a risk of fireplace, ton, quake, alien invasion…well okay, strike that last one. But normal disasters do occur, and banks are not immune to these things.

Therefore exactly what do you do to make sure that your safe deposit box is…well…safe?

The main point you can certainly do is to buy insurance for the contents of your box. Some banks give you a minimum level of insurance with the box (ask your bank to be sure) but this can improbable protect most of the articles of your box , especially if you have large price items.

Some people use private protection deposit box companies instead of banks. Most of the time, these businesses often offer a tad bit more in insurance for new depositors. Always check to see along with your specific box business what the general levels are.

Some things aren’t cover-able by insurance. Things like inventory certificates, for example, fall under this category. In that case, It is best to leave your inventory records on file along with your brokerage business since they are well endowed to handle these types of things. Your brokerage organization includes a legal duty to shield your records that is probably more convincing when compared to a banks safe deposit obligations.

this category. In that case, It is best to leave your inventory records on file along with your brokerage business since they are well endowed to handle these types of things. Your brokerage organization includes a legal duty to shield your records that is probably more convincing when compared to a banks safe deposit obligations.

One answer (well a SORT of solution) is to help keep numerous safe deposit box Singapore at multiple banks in numerous towns. That you do not want to keep numerous boxes at the exact same bank, because if a fireplace strikes, most of the boxes are certain to get destroyed equally.

And you do not want to keep multiple boxes at banks that are shut to one another, because if a earthquake or flood hits, chances are all the banks locally could be hit. I would suggest maintaining 2 or 3 boxes in a number of villages, each within about one hour operating distance.

An hour is much enough out therefore a normal disaster of some kind would probably miss each bank, however perhaps not past an acceptable limit away that you can not make it in one hour or so. Yet another alternative is always to start a box in the city wherever you usually vacation, or one in that you travel to frequently for business.

Keeping your safe deposit box safe is really a complicated matter. However you get fixing this little problem, for as long everbody knows that possible problem exists, you are previously way in front of the game. I suggest you use a mix of insurance for the high-worth products and diversification for all your others.